|

| Over the past 10 months, Femsa has issued one million of its 'Saldazo' cards, for a rate of about 100,000 cards a month. The number of people actively using the cards is roughly two times the industry norm. |

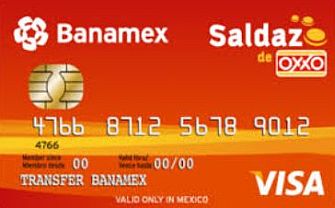

Mexico City, Mexico — Mexican convenience store operator Femsa reported on Tuesday that their new bank card appears to be a runaway success, opening another financial option for the many Mexicans who don't use banks.

Over the past 10 months, Monterrey-based Femsa has issued one million of its so-called "Saldazo" cards, for a rate of about 100,000 cards a month, Juan Fonseca, Femsa’s head of investor relations, told analysts during a conference call.

"This is the first banking relationship for most of the users of this product," said Mr. Fonseca, adding that the number of people actively using the cards is roughly two times the industry norm.

|

Every day, close to nine million people make a purchase at one of Femsa’s Oxxo stores, according to the company. It had 12,395 outlets across Mexico at the end of September, for a penetration in some areas on par with the convenience store market in the US.

Oxxo launched the Saldazo card in February together with the Mexican unit of Citigroup Inc. and Visa. It functions as a debit card that takes deposits of up to $7,000 Mexican pesos ($520) a month, allowing users to make purchases, withdrawals, and transfer prepaid airtime to their mobile phones.

Mr. Fonseca said the main benefit of the cards for Oxxo is to generate data, saying that the Saldazo cards don't generate a lot of fees. Once the retailer mines all the data, it hopes to use the information to tailor in-store promotions.

Attempts by some other Mexican retailers to migrate consumers to credit cards have largely received lukewarm responses.

Traditional bank accounts are also shunned by many, with the World Bank estimating that less than 30% of adults in Mexico having a bank account, compared to 56% in Brazil.

Original Story

No comments:

Post a Comment