Two years after Mexico President Enrique Pena Nieto won election on a promise to boost growth, foreign investors are buying his vision. Their Mexican counterparts increasingly are doubting it.

Mexicans cut their holdings of the nation’s equities by 45 percent in the past year and are now the most bearish relative to foreigners since at least 2010, based on data for BlackRock Inc. exchange-traded funds. Global investors raised holdings during the same period. Pena Nieto’s approval rating has fallen to less than 40 percent from 55 percent in the first quarter of last year, according to polling agency GEA-ISA.

Changes pushed by Pena Nieto that won Mexico praise from bond traders and credit-rating companies, such as increasing sales and income taxes to wean the government off oil revenue, are hurting consumers and his popularity. Voters approve of Pena Nieto less than his two predecessors at this point in their administrations and say their biggest concern is growth that missed analyst estimates in seven of the past eight quarters.

“For the foreign investor that has funds in emerging markets, there isn’t another country that looks better than Mexico,” Luis Maizel, who manages about $5.5 billion in fixed-income securities including Mexican bonds as president of the San Diego-based LM Capital Group LLC, said in a phone interview from Mexico City. “From 30,000 feet above ground everything looks very positive. But those with their feet on the ground see their companies aren’t selling.”

Market Performance

The benchmark IPC index of 35 Mexican stocks has advanced 3.9 percent since the day before Pena Nieto took office on Dec. 1, 2012. The increase for the comparable period under his predecessor, Felipe Calderon, was 14 percent, while Vicente Fox presided over a 14 percent gain.

The IPC fell 0.1 percent to 43,403.43 at the close in Mexico City.

The economy expanded 1.1 percent in Pena Nieto’s first full year as president, compared with 3.1 percent in Calderon’s. The economy shrank during Fox’s first year.

The signs of a consumer-led pick-up have been few. Sara Martinez, 38, says customer traffic has tumbled this year at the juice-and-milkshake stand she runs in Mexico City. Antonio Bermudez said a sales decline that began in February at his two shoe stores accelerated last month.

“With a new president, we thought that within a year everything was going to get better, but it’s been a year and-a-half and the situation is getting worse,” said Bermudez, 59. “People don’t have money in their pockets and inventory isn’t turning over.”

Similar Sluggishness

Larger companies are coping with similar sluggishness. Same-store sales at Wal-Mart de Mexico SAB, the nation’s largest retailer, declined 0.7 percent during the first half of the year. The drop was 3.5 percent through May for supermarket chains and department stores represented by a trade group called Antad, whose members include Organizacion Soriana SAB and Costco Wholesale Corp.’s Mexico unit.

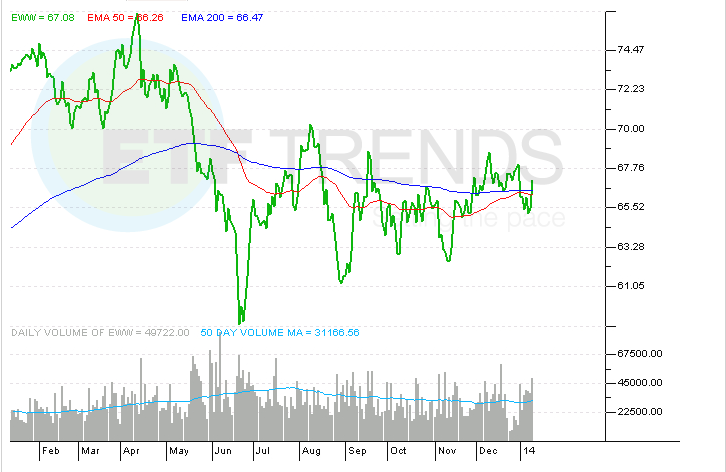

Shares outstanding in the 61.6 billion peso ($4.73 billion) iShares NAFTRAC, the largest ETF incorporated in Mexico, have declined 45 percent over the past year amid withdrawals, according to data compiled by Bloomberg. The biggest Mexico-focused ETF in the U.S., iShares MSCI Mexico Capped ETF, with a market capitalization of $2.88 billion, saw shares outstanding increase 26 percent amid buying over the same period.

The funds, the two largest ETFs with an emphasis on Mexico, are operated by New York-based BlackRock, the world’s largest money manager. ETFs are bundles of securities that trade like stocks on an exchange and typically track an equity, bond, commodity or currency index.

Cutting Forecasts

Some withdrawals by local investors may reflect an interest in buying individual Mexican stocks instead of broader indexes, according to Jorge Lagunas, who manages $200 million at Grupo Financiero Interacciones. The withdrawals also track reduced expectations for the nation’s $1.2 trillion economy, the second biggest in Latin America.

The Finance Ministry lowered its forecast for 2014 growth to 2.7 percent in May from the previous estimate of 3.9 percent after the economy expanded 1.8 percent in the first quarter, below the 2.1 percent median forecast in a Bloomberg survey. The government cut its 2013 forecast four times last year as the economy grew at the slowest pace since 2009 and less than one third of the Pena Nieto administration’s original 3.5 percent forecast.

The central bank has repeatedly stepped in to provide stimulus, lowering interest rates four times by a total 1.5 percentage point since March 2013 to a record-low 3 percent. Three of the cuts weren’t predicted by the median forecast of economists in Bloomberg surveys.

Policy Changes

Pena Nieto, 47, has said Mexico needs to grow faster than the 2.6 percent average of the past two decades and has pushed through a raft of legislation aimed at boosting growth, from opening the oil industry to more private investment to spurring more competition in banking and telecommunications.

He also passed a tax increase that will cut Mexico’s dependence on oil revenue to as little as 27 percent of the budget by 2018, when he leaves office, from 34 percent last year.

Those moves won approval from Standard & Poor’s and Moody’s Investors Service, which both upgraded Mexico in the past seven months. The cost to protect the nation’s debt against default fell last month to 0.65 percentage point, the least risky since 2007, according to data compiled by Bloomberg.

“This government has accomplished more in the last year than the three preceding administrations combined,” Richard Fisher, president of the Federal Reserve Bank of Dallas, told a lecture hall that included economists from the nation’s biggest banks and central bank Governor Agustin Carstens during a visit to Mexico City on March 5.

More Taxes

Yet, in a GEA-ISA poll last month 54 percent of Mexicans described the economy as “bad,” up from 45 percent in early 2013. The nationwide survey of 1,000 people had a margin of error of 3 percent. Fifty percent said they were paying more taxes this year while 36 percent said they believed they would be harmed by Pena Nieto’s energy overhaul, which is aimed at attracting investment from oil companies such as Exxon Mobil Corp. (XOM:US) and Chevron Corp. (CVX:US) to reverse nine years of output declines.

“The reforms are not seen as accomplishments but as mistakes,” Guillermo Valdes, a partner at GEA, an economic consulting firm that worked with research firm ISA on the survey, told reporters in Mexico City on June 30.

Consumer Confidence

Pena Nieto’s 2014 revenue package increased the sales tax along the U.S. border and in some coastal areas to 16 percent from 11 percent and raised the top income levy on high earners. It also placed a new 1-peso-per liter duty on sugary drinks, an 8 percent tax on junk food and a 10 percent levy on capital gains. The moves were aimed at boosting tax revenue that equaled 20 percent of gross domestic product in 2011, the lowest among 34 nations in the Organization for Economic Cooperation and Development, according to data from the group.

Consumer confidence tumbled to the lowest in almost four years after the new taxes took effect Jan. 1 and still languishes below its year-ago levels even after a rebound in recent months. Mexico’s gross domestic product may expand 3.8 percent next year, according to 28 analyst estimates compiled by Bloomberg.

If economic weakness continues, it could spell trouble for Pena Nieto’s Institutional Revolutionary Party, or PRI, next June when Mexicans go to the polls to elect all 500 members of the lower house of Congress and governors in nine states, said Gabriel Casillas, chief economist at Grupo Financiero Banorte SAB.

“There’s a lot of political pressure,” Casillas said in a phone interview from Mexico City. “Foreign investors know that to see the benefits of structural reforms, a lot of times you have to make a down payment up front, and then in the medium term you get the benefits. In Mexico investors and people on the street see that, on a day to day basis, we’re facing those costs.”